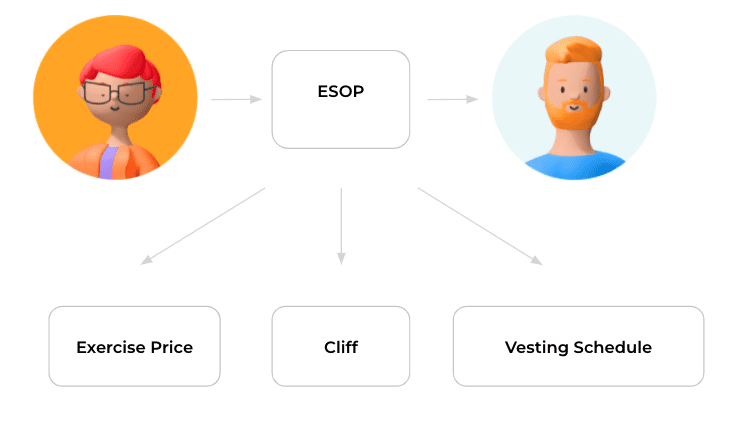

Key elements on how stock options work

You are about to be hired in a startup and you are offered employee stock-options. Your future employer sends you an Employee Stock Ownership Plan (ESOP) with words like Vesting or Cliff.

What do these words mean?

Vesting schedule

The vesting schedule defines the dates on which the beneficiary will have his/her employee stock-options vested. In other words, the dates when the beneficiary will own the employee stock-options.

Stock-options are not shares of a business (read our article on the difference between the two).

The vesting schedule defines the rate at which stock options vest and become exercisable.

On average, it will take 4 years for a beneficiary to own 100% of the employee stock-options.

Cliff

A cliff is a timeframe during which the beneficiary is not vesting his/her employee stock options. In general, in a stock option plan, the first year is a “cliff”. This means that the beneficiary does not vest until the end of the first year. With a 4 year plan, after 12 months, the beneficiary will own 25% (one quarter) of the number of employee stock-options in his/her contract.

Exercise Price or Strike Price

The exercise price or strike price is the current price of a share. This exercise price will be the amount of money for each share that the beneficiary will need to pay to exercise his / her right to own a share.

To better understand, if the exercise price is $1, then the beneficiary will need to pay $1 to acquire a share of the company. In other words, if the price per share exceeds $1, the beneficiary will make money.